Why Short-Term Rentals Outperform Other Investments (Even Without the STR Loophole)

At a Glance

- Higher gross revenue: STRs often generate 2–4x more income than long-term rentals.

- Built-in flexibility: Dynamic pricing and multiple revenue streams boost margins.

- Better ROI baseline: Well-run STRs often hit 15–30% CoC returns, compared to 6–10% for LTRs or REITs.

- Management optionality: Even fully managed STRs outperform long-term rentals.

- STR Loophole = jet fuel: Unlocks depreciation to offset W2 income, boosting after-tax ROI.

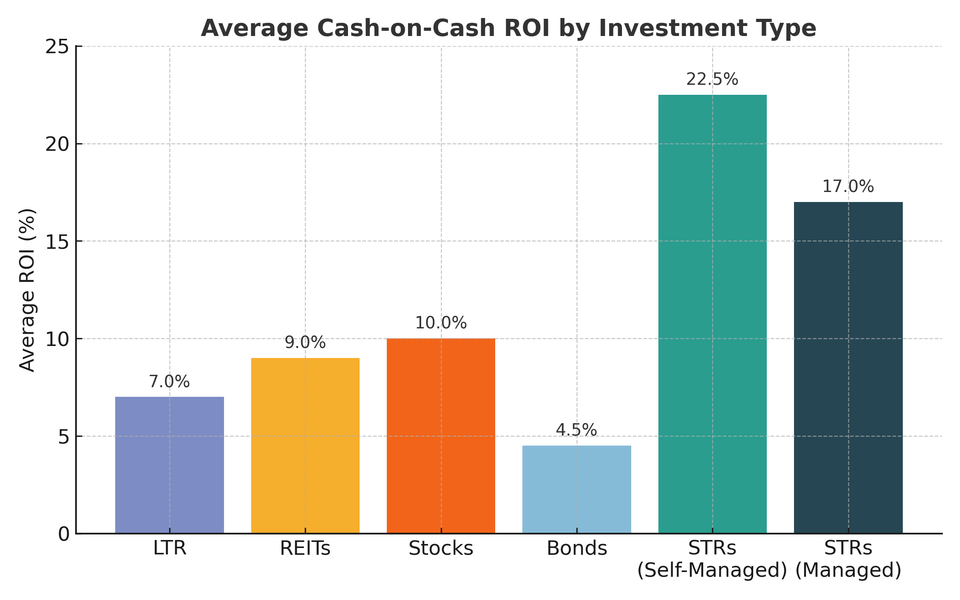

STRs vs. Other Investments: The Baseline ROI

Think the STR Loophole is the only reason short-term rentals outperform other investments? Think again.

Even without tax perks, STRs consistently deliver stronger ROI than long-term rentals, REITs, stocks, or bonds. Here’s why:

- Higher Gross Revenue Potential – One property can earn 2–4x what it would as a long-term rental.

- Dynamic Pricing – Adjust rates in real time to match demand instead of being locked into fixed leases.

- Multiple Revenue Streams – Cleaning fees, upsells, and add-on experiences create additional profit centers.

How STRs Stack Up

| Investment Type | Typical Returns (CoC / Annualized) | Notes |

|---|---|---|

| Short-Term Rentals | 15–30% (well-run, pre-tax perks) | Flexible pricing, high cashflow |

| Long-Term Rentals | 6–8% | Stable but lower upside |

| REITs | 8–10% (before fees) | Liquid but fee-heavy |

| Stocks (S&P 500 avg.) | ~10% (over decades) | Volatile, long time horizon |

| Bonds / CDs | 3–6% | Low risk, low reward |

💡 Key Takeaway: STRs outperform even before tax strategies enter the picture.

The Management Factor: Self-Managed vs. Professional

A common misconception is that STRs require constant hands-on management. That’s only true if you want it to be.

- Self-Managed STRs – Highest ROI potential, especially if you leverage automation tools for guest communication, dynamic pricing, and cleaner scheduling.

- Professionally Managed STRs – Slightly lower margins (due to 20–30% management fees), but still outperform long-term rentals on comparable properties.

“Even a fully managed STR can beat a long-term rental’s returns—making STRs one of the most flexible wealth vehicles for busy W2 earners.”

Where the STR Loophole Changes the Game

This is where things go from great to life-changing.

The STR Loophole allows qualifying STR owners to claim significant depreciation losses against W2 or other active income—without needing full-time real estate professional status.

Example Scenario

- Without Loophole: A property nets ~18% CoC ROI.

- With Loophole + Cost Segregation + 100% Bonus Depreciation: That same property’s after-tax ROI can exceed 50% in year one.

📌 For a deeper dive, read our guide: The 6-Phase Journey: How W2 Earners Build Wealth with STRs

The Bottom Line

Short-term rentals are already a strong wealth-building strategy—even if you never touch the STR Loophole. But if you can qualify? You’re simply adding jet fuel to an already powerful engine.

👉 Ready to start building your STR portfolio the right way? Join the ViaSTR Community for free to access guides, calculators, and vetted partners who can help you every step of the way.